You may also incur ATM withdrawal fees of $2.50, check deposit fees ranging from $0 to 5% of the total check amount and a 4% fee on purchases made outside the U.S. The PayPal Prepaid Mastercard® can cost up to $4.95 to purchase the card ($0 if you get the card online) and charges you $4.95 a month to use the card. You can also expect to incur an ATM fee, reload fee and foreign transaction fee with many prepaid cards.

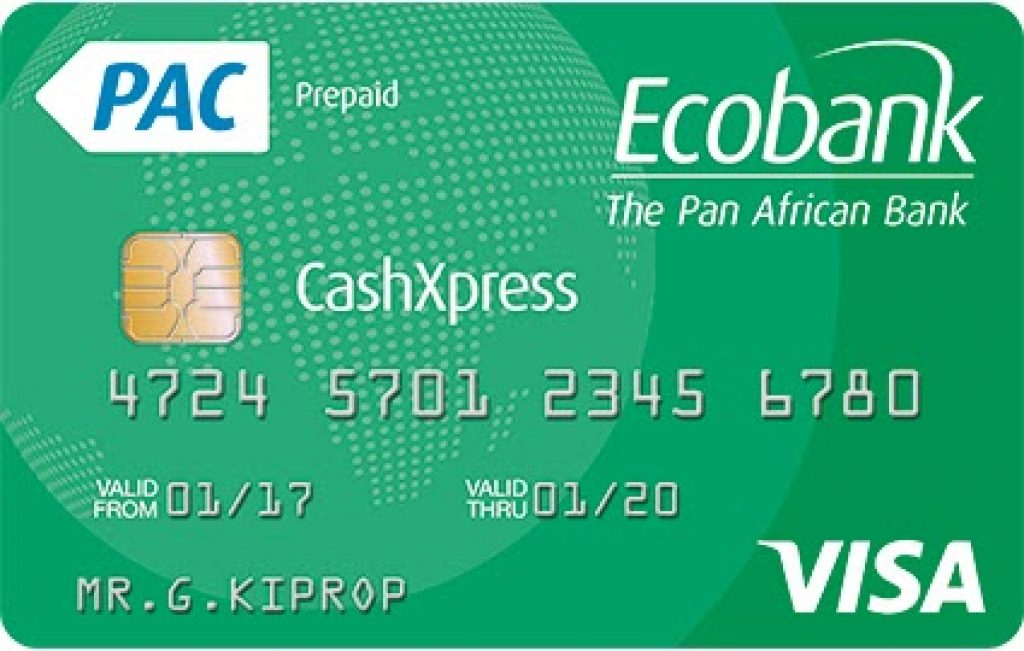

But you may also pay a fee to open your prepaid card, typically around $5. Most prepaid cards charge monthly maintenance fees around $10, which is similar to checking account fees that can cost up to $15 a month. Any purchases you attempt to make exceeding $200 will be declined until you load more money onto your card.īefore you open a prepaid card, it's important to understand what fees may be associated with them. If you add $200 to your prepaid card, you can only spend up to $200. One disadvantage of using a prepaid card is that you can only complete transactions up to the amount you have loaded onto it. Issuers won't do a credit check when you open a prepaid card, but you also don't build a credit history when you use one. They are accepted nearly everywhere since they are often backed by a major card network, such as Visa, Mastercard or American Express. Prepaid cards can be used to make purchases and pay bills, just like debit or credit cards. They also require more attention since you can incur fees for simply having a card or reloading it with more cash.

But prepaid cards come with a few more bells and whistles, like the ability to set up direct deposit and check your balance on a mobile app. Similar to a gift card, you add value to the prepaid card before you can use it, which is essentially like prepaying for future purchases.

0 kommentar(er)

0 kommentar(er)